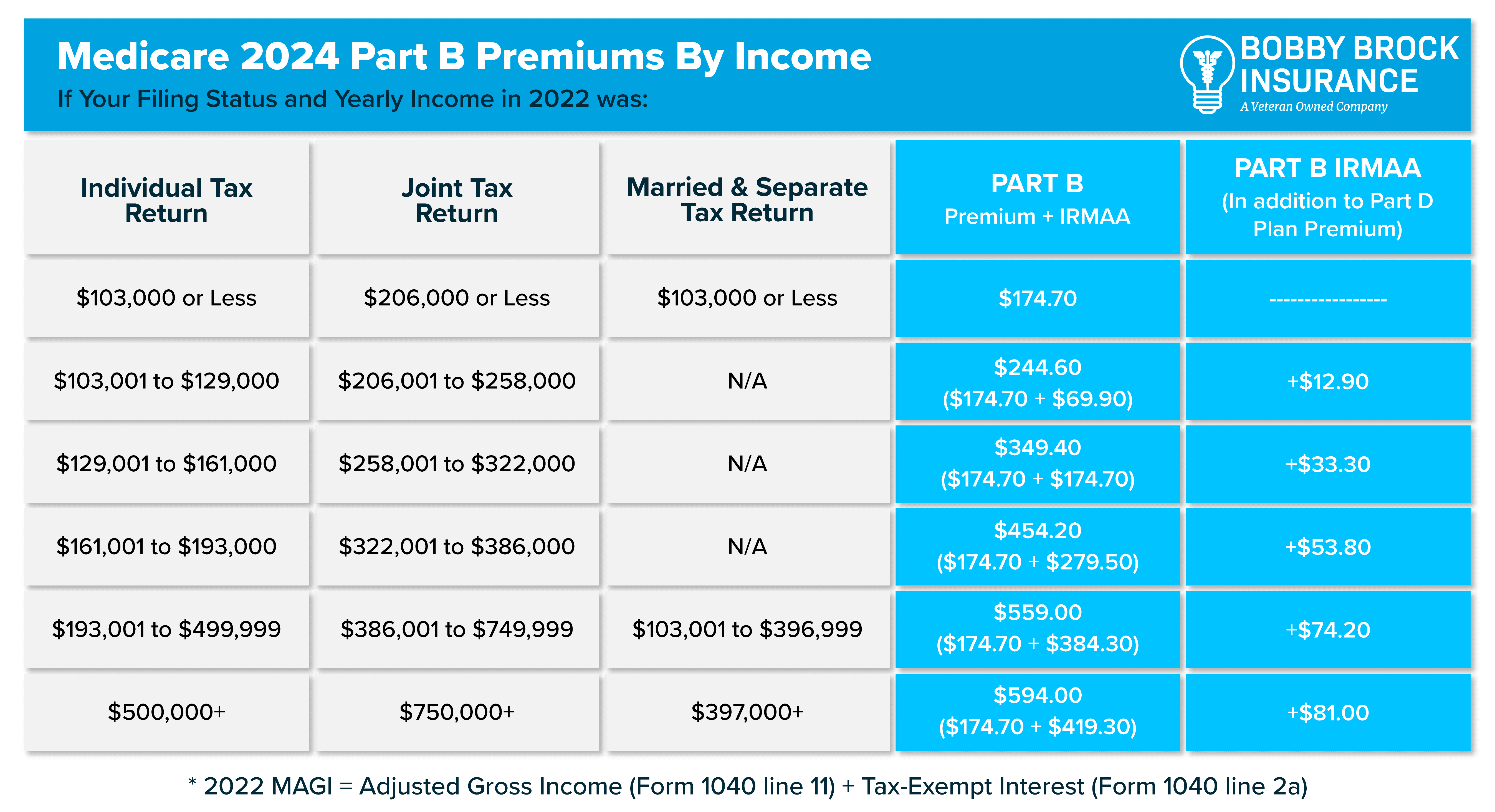

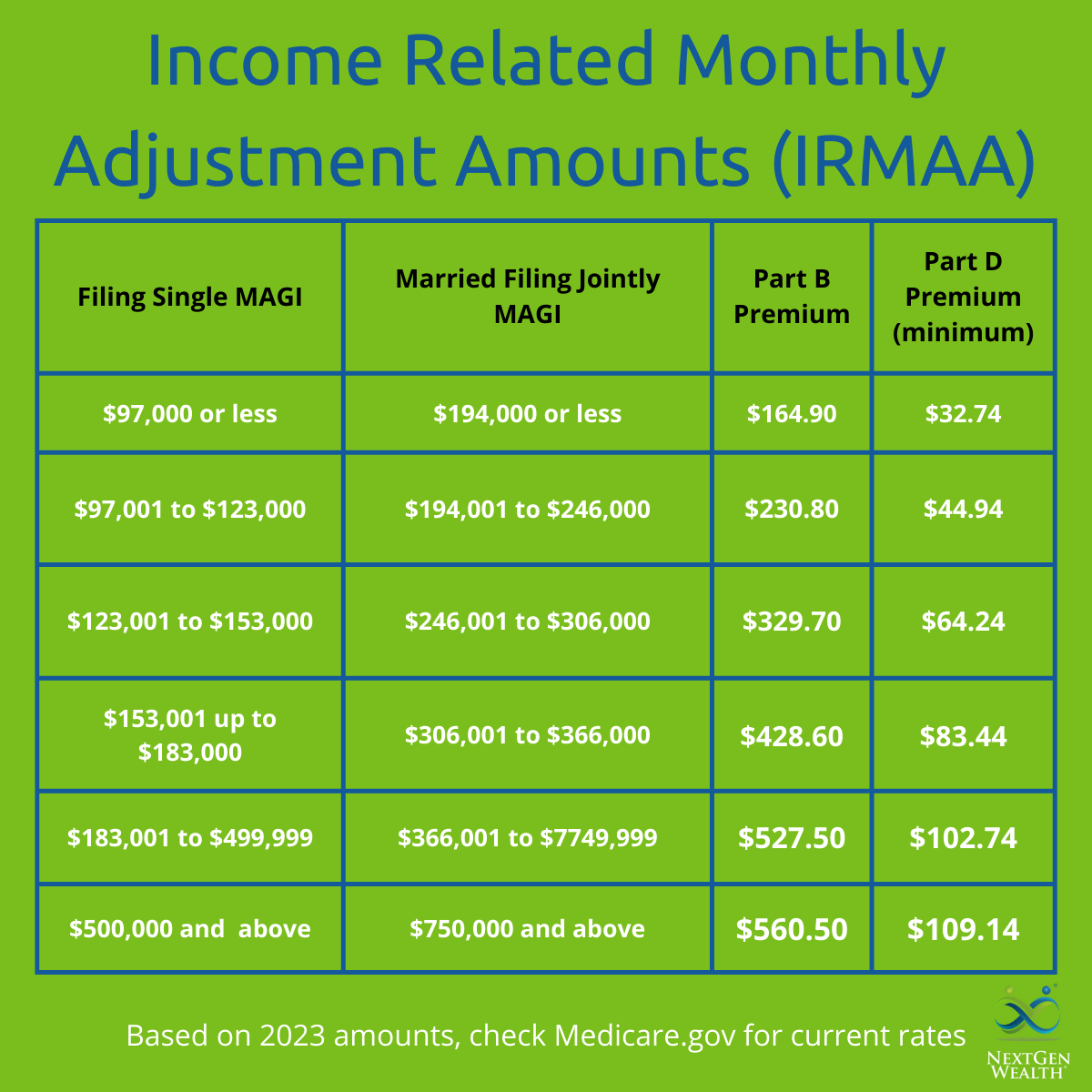

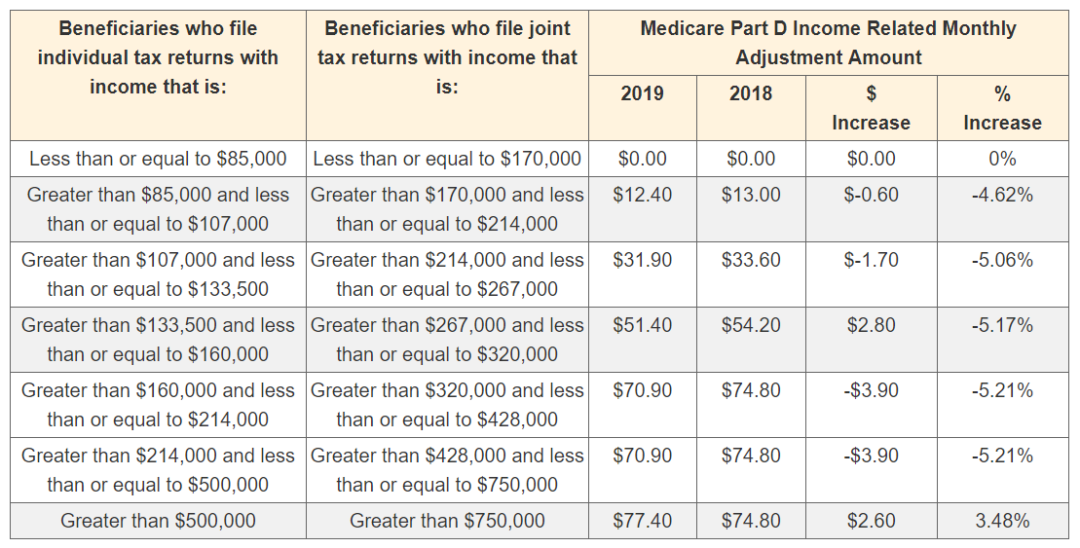

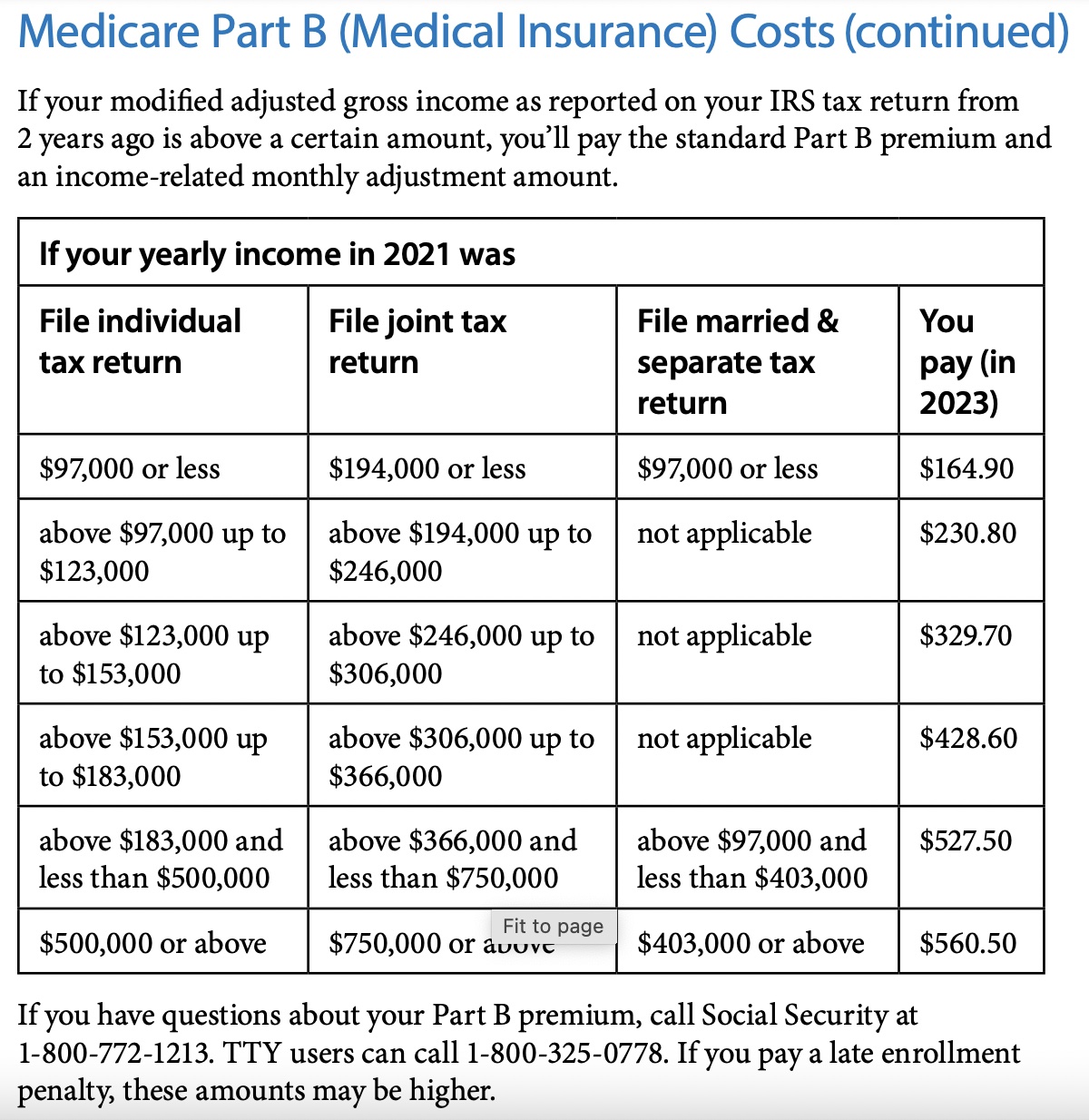

Irmaa Chart 2024 Part B. People with medicare who earn a high income have to pay an irmaa, an extra charge on medicare parts b and d. In 2024, if your 2022 income exceeded $103,000 (for an individual return) or $206,000 (for a joint return), you will pay an extra amount on top of your plan’s part b and part d premiums.

What are the 2024 irmaa brackets? In 2024, if your 2022 income exceeded $103,000 (for an individual return) or $206,000 (for a joint return), you will pay an extra amount on top of your plan’s part b and part d premiums.

Irmaa Chart 2024 Part B Images References :

Source: bobbybrockinsurance.com

Source: bobbybrockinsurance.com

Your Guide to 2024 Medicare Part A and Part B BBI, On october 12, 2023, the centers for medicare & medicaid services (cms) released the 2024 premiums, deductibles, and coinsurance amounts for the medicare part a and part b.

Source: www.healthcareretirementplanner.com

Source: www.healthcareretirementplanner.com

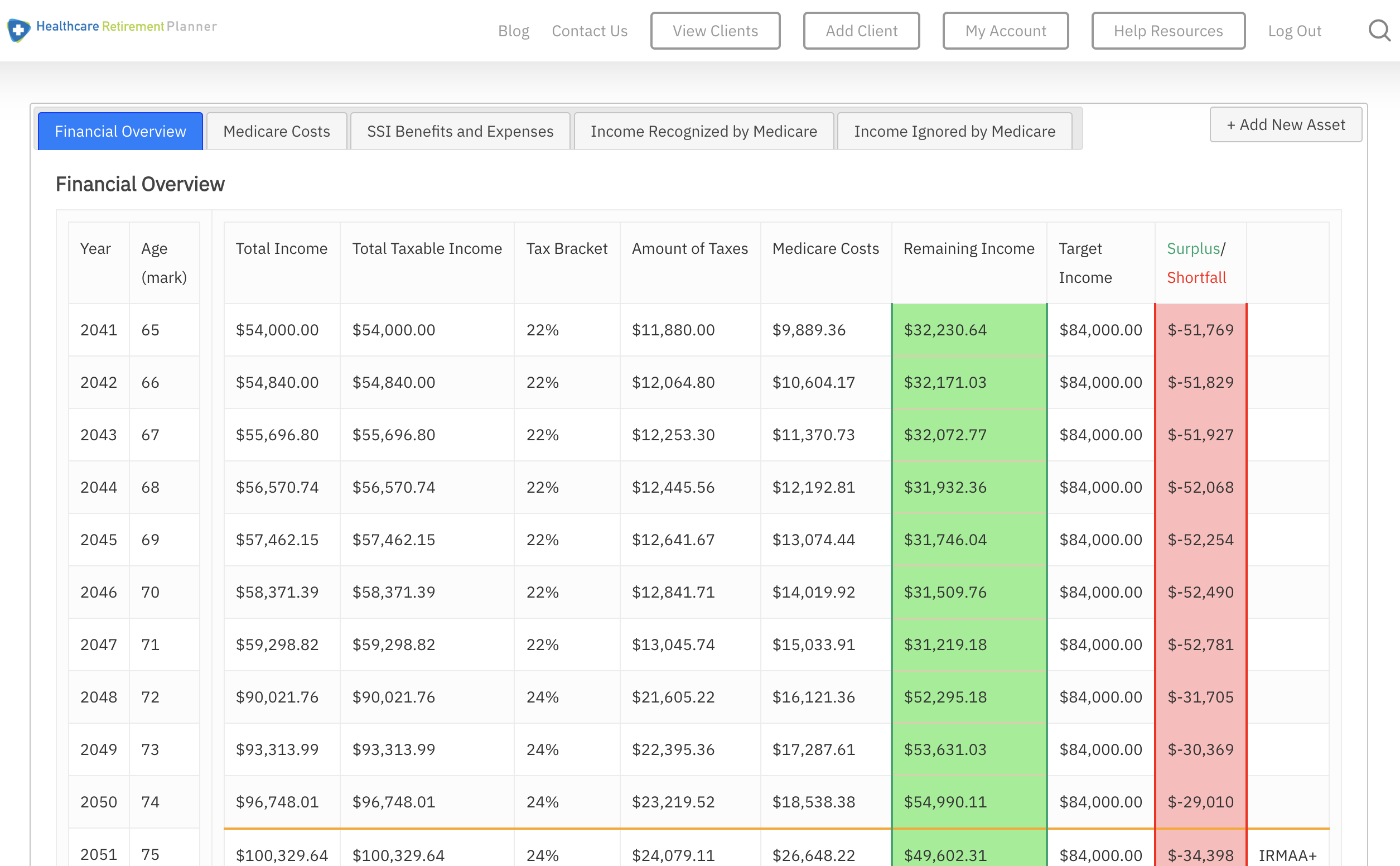

Medicare IRMAA 2024 What to Expect for Surcharges in the Coming Year, What are the 2024 irmaa brackets?

Source: roanaybetteyann.pages.dev

Source: roanaybetteyann.pages.dev

2024 Irmaa Brackets For Medicare Part B And D Cyndie Trudie, On october 12, 2023, the centers for medicare & medicaid services (cms) released the 2024 premiums, deductibles, and coinsurance amounts for the medicare part a and part b.

Source: nedibmarybeth.pages.dev

Source: nedibmarybeth.pages.dev

2024 Part B Irmaa Chart Karna Joella, For 2024, the part b premium is $174.70 and the part d is $55.50.

Source: lillybbernadine.pages.dev

Source: lillybbernadine.pages.dev

2024 Irmaa Brackets Part B 2024 Cybil Dorelia, In 2024, the standard monthly medicare part b premium is $174.70 per month, but those who have a higher salary will have an irmaa charge and will have to pay more.

Source: cordeyblucille.pages.dev

Source: cordeyblucille.pages.dev

Projected 2024 Irmaa Brackets Roda Virgie, Irmaa is the income related monthly adjustment amount added to your medicare part b and medicare part d premiums.

Source: onidabclemmie.pages.dev

Source: onidabclemmie.pages.dev

Irmaa Chart 2024 Part B Cyndy Doretta, Irmaa charges are determined by using the modified adjusted gross income (magi) reported on your taxes from two years prior.

Source: amiiqauguste.pages.dev

Source: amiiqauguste.pages.dev

Irmaa Levels For 2024 Inge Regine, For 2024, the income brackets for part b and part d are the same.

Source: aviebcorissa.pages.dev

Source: aviebcorissa.pages.dev

2024 Part B Irmaa Brackets Zia Lilyan, The standard part b premium for 2024 is $174.70.

Source: mistipaulie.pages.dev

Source: mistipaulie.pages.dev

Irmaa 2024 Table Chart Letta Doralia, In 2024, if your 2022 income exceeded $103,000 (for an individual return) or $206,000 (for a joint return), you will pay an extra amount on top of your plan’s part b and part d premiums.

Category: 2024